What’s your most visited website? If it’s Google or Facebook, you’re certainly not alone with Google accounting for more than 98% of search traffic originating from Australian mobile users in 2018. But as the discussions between the tech giants and the Australian Government over a proposed media code heats up, that all may be about to change. This week, Google has stepped up and threatened to pull Australian access to the search engine if the proposed revenue-sharing media laws go ahead. On the other hand, Australian Treasurer Josh Frydenberg has said that it is “inevitable” that tech giants Google and Facebook will pay for Australian news.

So what is actually going on?

The Legislation

The proposed law states that Australian media outlets can negotiate individually or collectively with Facebook and Google over payment for content used and shared on the tech giants’ sites, with other platforms potentially to be added over time. That’s right, the laws would require the companies to pay Australian media companies to link to the content in searches. Google says that this would “dismantle a free and open service that’s been built to serve everyone.”

ScoMo’s response? “We don’t respond to threats.”

But Why?

It’s no secret that traditional media companies in Australia have been struggling in recent years with hits to revenue streams such as subscriptions and advertising, and part of this is because of Google and Facebook. Shockingly, for every $100 spent on online advertising in Australia, excluding classifieds, nearly one-third goes to Google and Facebook.

In the course of their investigation, the ACCC found that news outlets lack bargaining power when it comes to negotiating with the tech giants over compensation for content publishing, in part because the outlets rely so heavily on Google and Facebook to reach readers.

What Does This Mean for Your Business?

If Google does say "cya" to Australia, it’s going to mean more than saying gday to a new search engine. It could have huge implications for your business.

Digital Advertising:

Many businesses (perhaps even yours) rely heavily on digital advertising through Google, with the digital advertising market for Google search in Australia valued at around $4.3 billion per year. Google now accounts for more than 51% of all online advertising. If Google is gone, the way that businesses advertise is going to have to go through a dramatic change. Your advertising dollars won’t stretch as far, as you’re going to have to channel advertising across multiple platforms.

Software and Hardware:

Do you use Android devices or Google Maps for your business? What about Google Docs or Google Drive? This added reliance on Google could leave your business stranded if Google decides to exit the Australian market.

Business Presence:

If Google were to exit the Australian market, you’re going to have to start over when it comes to establishing your online presence. Not only will you be unable to monitor Google’s content relating to your business, but you’re going to have to start over on other platforms. Think you know how to best optimise your keywords to work with Google? Well you may need to learn how the algorithm works on multiple other search engines.

New Opportunities

It’s not all bad news! If Google exits the Australian market, they will create space for new players to both enter the scene and increase their own business offerings. From developing new platforms to increasing existing business offerings to offer services that help in a new-Google-less world, the opportunities could very well be endless!

What Next?

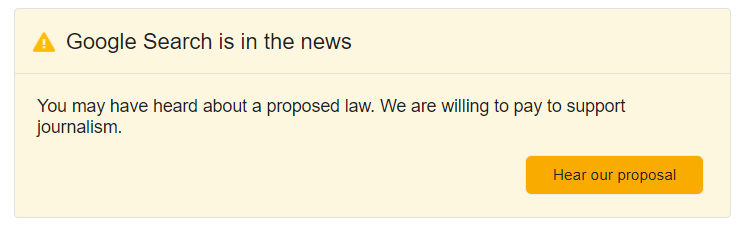

At the moment as negotiations between the Australian Government, Google, and Facebook continue, all parties are on a mission to win supporters. Google has raised the ante by including a message and link at the top of every page.

On the other side, the ACCC have announced that they may bring a third lawsuit against Google for misuse of market power in the advertising sector and breaching competition law and the Government have made it clear that they intend to continue the fight.

No matter what side you’re on, there probably will be huge implications for your business as the fight continues to ramp up!