Employers need to ensure they are aware that the superannuation guarantee will increase from 9.5% to 10% on 1 July 2021 and then continue to increase incrementally by 0.5% each year thereafter until it reaches 12% by 1 July 2025.

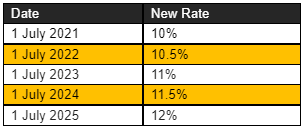

Be sure to add the below dates and rates into your calendars to ensure your business stays up to date with the incremental increases that are on the horizon:

From 1 July 2021, businesses need to ensure that their payroll systems are appropriately adjusted to comply with the increased superannuation guarantee rate and a failure to do so will expose the business to potential charges, fines, interest and administration fees imposed by the ATO.

Employers also need to ensure that they review their current employment contracts and pay close attention to the remuneration they currently provide to employees. If their remuneration package is inclusive of superannuation entitlements, the increased superannuation guarantee may be able to be absorbed into the employees existing remuneration package, however, this will mean their take-home pay will reduce. If the employee’s wage is exclusive of superannuation, additional superannuation will need to be paid.

For workers who are already receiving superannuation contributions above 10%, it is unlikely that any adjustments will need to be made, however, employers should still perform a thorough review for the sake of completeness and to ensure compliance.

If you have any questions in relation to the superannuation guarantee increases or if you would like assistance with ensuring your business is compliant, contact Enterprise Legal’s Workplace Relations team today:

☎️ (07) 4646 2621

✉️ Submit an Online Request